Track your investment portfolio

performance

Track the price and performance of all of your investments in one place. Calculate returns inclusive of dividends, currency fluctuations and more with reports built for investors like you.

Sign up for free

Track all your investments

Track automatically updated price and performance data on over 240,000 stocks, ETFs and mutual funds worldwide.

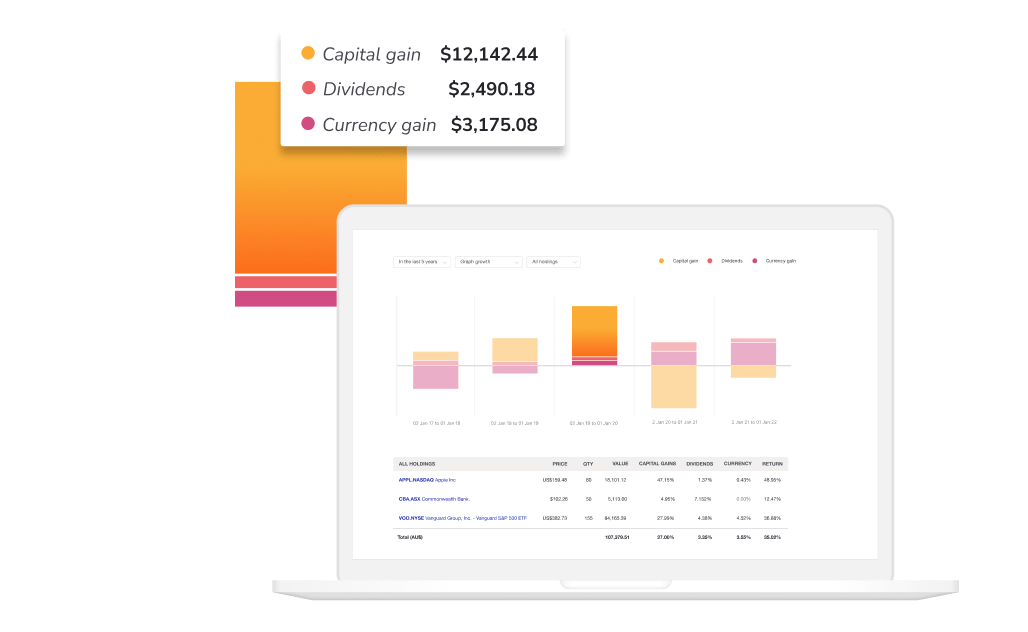

Calculate your total return

See more than your broker shows you – calculate your annualised return including capital gains, dividends and currency fluctuations.

Benchmark your portfolio

Compare against a world of investments – benchmark against any stock, ETF or mutual fund in Sharesight’s database.

"The ability to go beyond the spreadsheet is what this is all about."

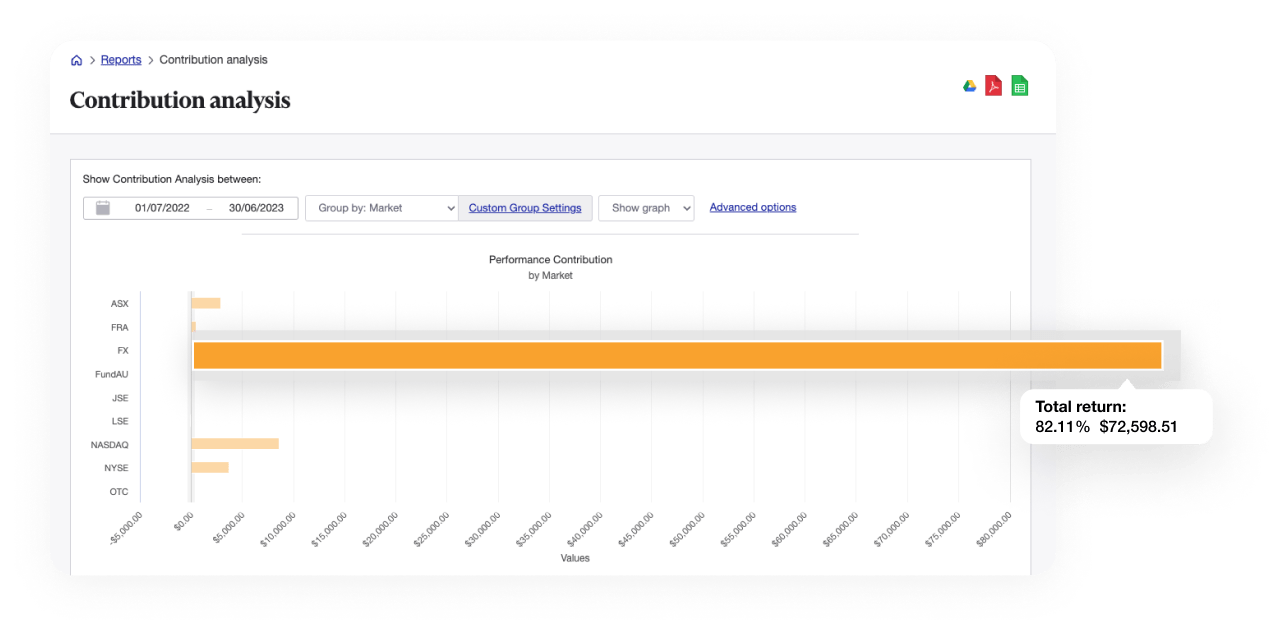

Understand the drivers of your performance

See how each of your holdings contributes to your overall portfolio performance, and easily identify non-performers with the Contribution Analysis Report.

Group the investments in your portfolio along the dimensions of your choice to compare performance across different countries, industries, sectors and more.

Powerful investment performance reports

Sharesight offers an advanced reporting suite designed by investors, for the needs of investors like you. Our reporting suite includes everything you need to evaluate your investment portfolio performance, calculate your portfolio diversity and make smarter investment decisions today, tomorrow, and beyond.

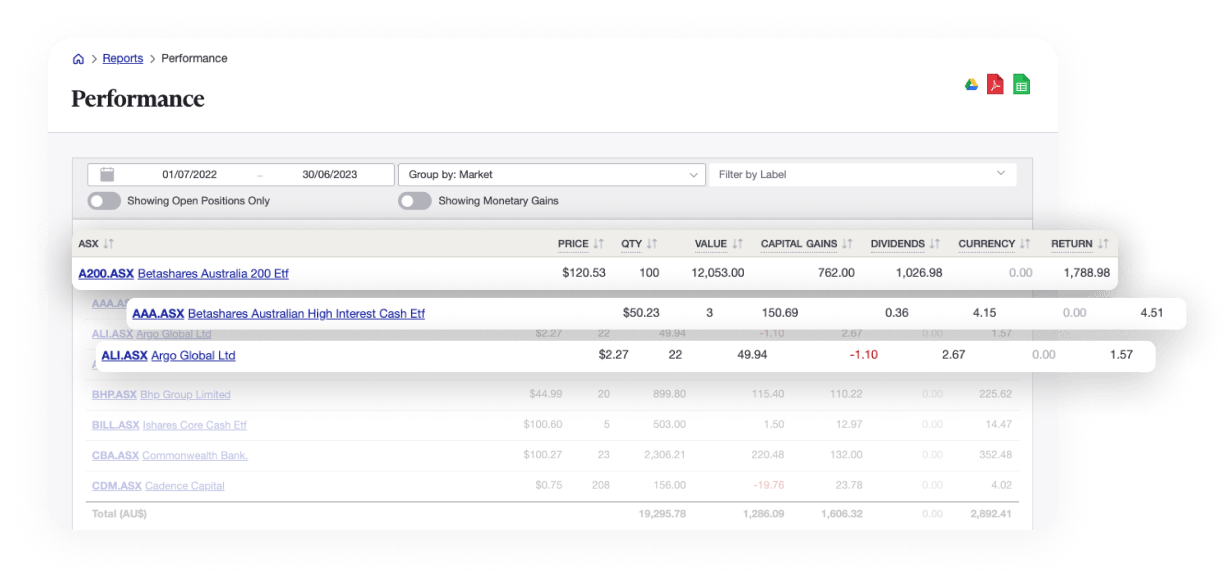

Track investment performance over any period

Calculate the impact of capital gains, dividends and currency fluctuations on your portfolio with the Performance Report. Break down your performance along a range of preset and custom dimensions including country, market, industry and more. Compare how different investments perform within your portfolio and add custom labels to further filter the report.

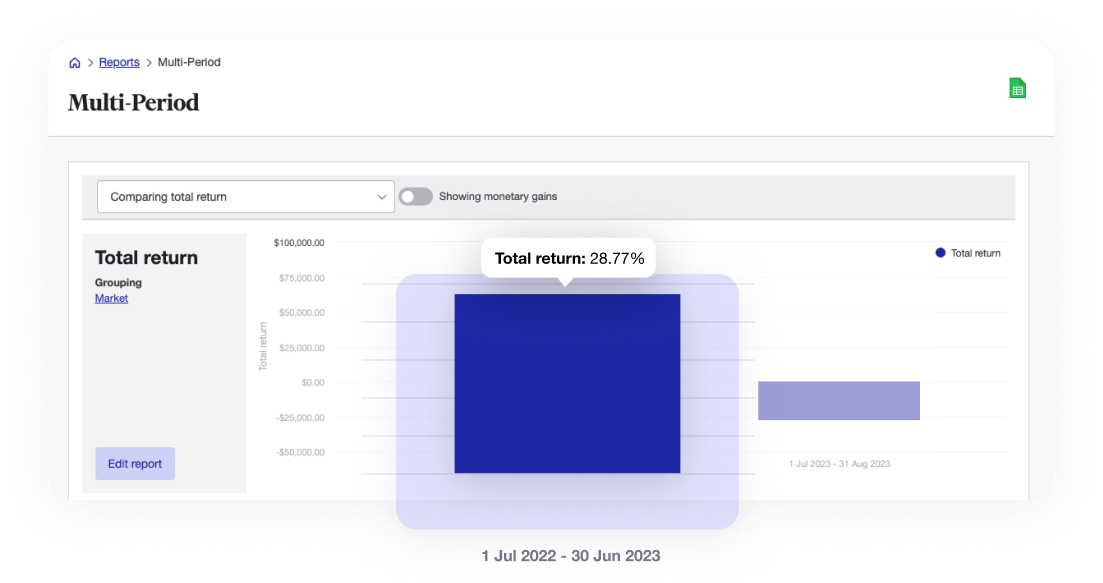

Compare your performance over multiple periods

Measure the performance of your investments over up to 5 distinct or cumulative time periods with the Multi-Period Report. View your portfolio’s capital gains, payout gains and currency gains in percentage or monetary values across time.

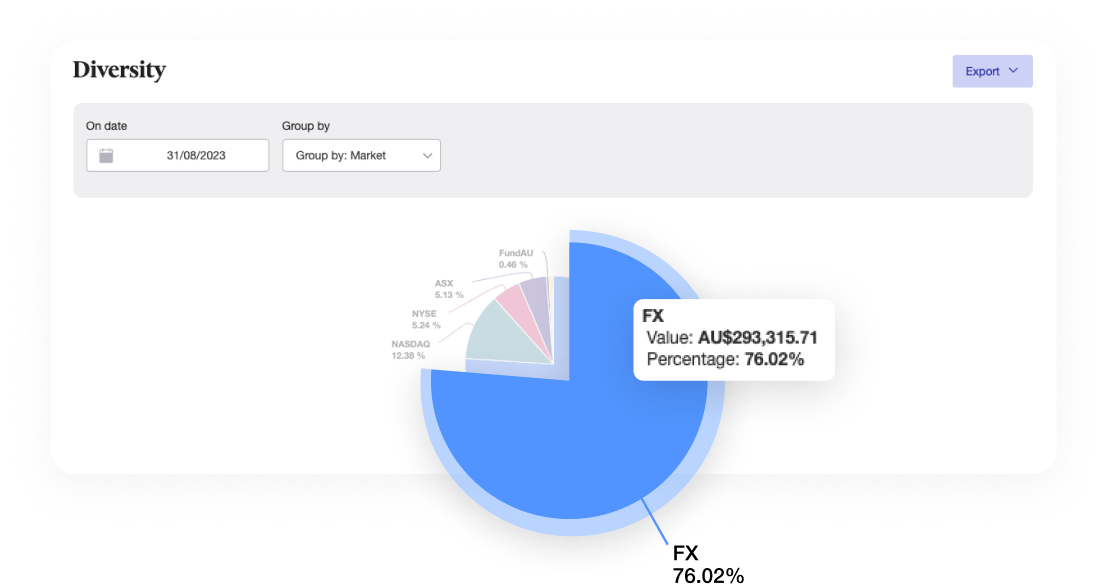

Visualise your portfolio diversity

Track your asset allocation and calculate your portfolio diversity across FACTSET investment classifications or your own groupings with the Diversity Report. This makes it easy to rebalance your portfolio to your target asset allocation.

Get the most out of your portfolio

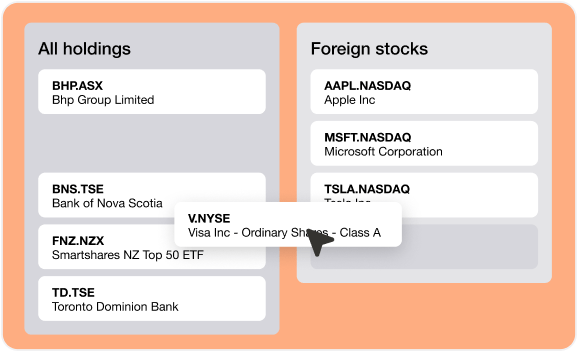

Specify custom dimensions

Create your own Custom Groups to organise your holdings and specify your methodology (great for asset allocation reporting).

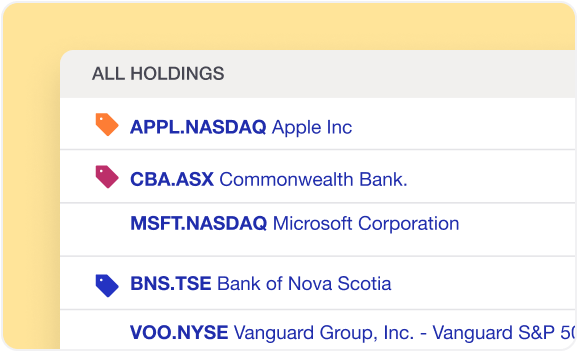

Label your holdings

Further organise your holdings and create custom filtered reports on specific subsets of holdings within your portfolio.

View wealth holistically

Invest across both personal and retirement accounts? See the complete picture by running reports across multiple portfolios.

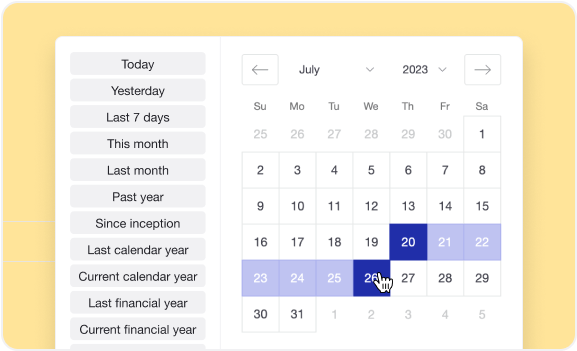

Report on any period

Run your performance reports over preset timeframes, or specific dates, going back over 20 years.

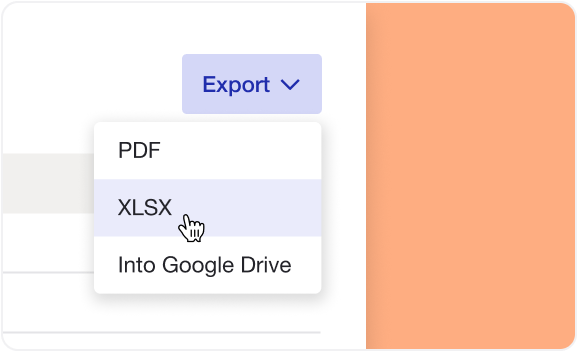

Export your reports

Download your performance & tax reports to PDF, Excel or Google Sheets for additional analysis or safekeeping.

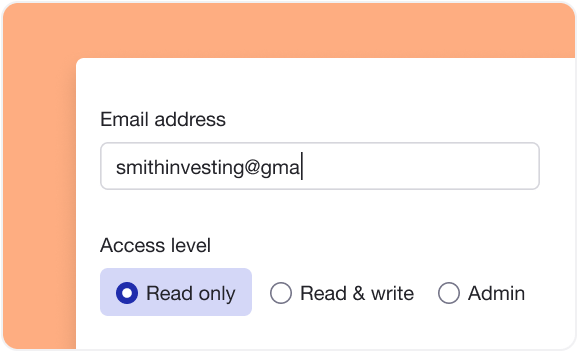

Share your portfolio

Share secure portfolio access with your accountant, financial advisor or family members, with tiered permission levels.

Don't just take our word for it

Over 300,000+ investors track their investments with Sharesight. Here’s what a few of them have to say:

Performance questions

How do you calculate the performance of an investment portfolio?

Sharesight’s investment portfolio management software gives investors the full picture of their portfolio’s performance by including the impact of capital gains, brokerage fees, dividends and currency fluctuations when evaluating investment portfolio returns. Rather than simply stating the difference between an investment’s buy and sell (or current) price, Sharesight also calculates returns on an annualised basis. Displaying the annual return allows investors to see their rate of return and compare the relative performance of their investments (and portfolio) over the same and different time periods. To view a portfolio’s performance data at a glance, investors can also use Sharesight’s investment portfolio Performance Report.

How to calculate portfolio diversity?

Sharesight users can easily calculate stock portfolio diversity by running the Diversity Report. The report gives users a detailed breakdown of their asset allocation based on the classification of their choice, including market, currency, sector, industry, investment type, country or a custom grouping determined by the investment attributes of their choice. This is one of the ways that Sharesight gives investors the important information they need to make informed investment decisions and rebalance their portfolio as needed, ensuring a diverse stock portfolio.

How to calculate investment performance over different time periods?

Investors looking to see the impact of time on their performance will benefit from Sharesight’s annualised performance calculation methodology, which makes it easy to compare the relative performance of investments (and your portfolio) over the same and different time periods. For a more detailed portfolio performance comparison over different time periods, investors can use Sharesight's Multi-Period Report. This report allows investors to compare their portfolio returns over a choice of up to five distinct or cumulative periods, making it an effective way to see the impact of a portfolio rebalance, evaluate performance before and after a market correction or even compare a portfolio’s returns against fund manager performance periods.

How to calculate performance of investments in different currencies?

Sharesight users with investments across different currencies can clearly see the impact of foreign currency fluctuations on their returns by viewing their total return on the Portfolio Overview page or by clicking into individual holdings. Investors can also use Sharesight's Multi-Currency Valuation Report to see the value of every investment in their portfolio denominated in both the currency it is traded in as well as its value when converted to any of the 100 currencies Sharesight supports. This is a useful online investment portfolio tool for investors who invest in one currency, but ‘think’ in another currency, such as expats or global investors with investments across multiple markets and currencies.

How to calculate the contribution of different investments to portfolio returns?

Sharesight's Contribution Analysis Report is a useful tool for investors who want to see the impact of different investments on their total portfolio return. The report shows the contribution of different groups of investments to the portfolio’s performance, with the option to sort investments by marketcurrency, sector, industry, investment type, country or a custom grouping determined by the investment attributes of your choice. This allows investors to see the components that are driving returns, such as stock selection, asset allocation, or exposure to certain countries, sectors, or industries.

How to benchmark investment portfolio performance?

With Sharesight, it’s possible to benchmark investment portfolios against over 240,000 global stocks, ETFs and mutual funds, including major indices. This can be done simply by clicking ‘Add a benchmark’ on the Portfolio Overview page and choosing a benchmark that aligns with your investment goals, or tracks a basket of stocks that will give you a like-for-like comparison with your own portfolio. This is one strategy investors can use to compare portfolio performance with the broader market and put their returns into context, which is especially useful in times of market volatility.