Markdown collapsible section test

Frequently asked questions

What can I track in Sharesight?

What can I track in Sharesight?

You can use Sharesight to track the following investments:

- Stocks, bonds, and ETFs from over 30 stock exchanges (including dividends and distributions)

- Australian, New Zealand, Canadian, and UK mutual/managed investment funds (U.S. mutual funds planned for late 2021)

- Global currencies

- 8 major cryptocurrencies

Please note that Sharesight does not allow tracking of short selling or CFDs.

How do I import my share portfolio?

How do I import my share portfolio?

We integrate with a growing list of online brokers which allows you to automatically import and track all your trading history in just a few clicks.

You can also import your trading history via CSV (Excel) or simply by entering trades manually.

What if I trade cryptocurrencies not supported by Sharesight?

What if I trade cryptocurrencies not supported by Sharesight?

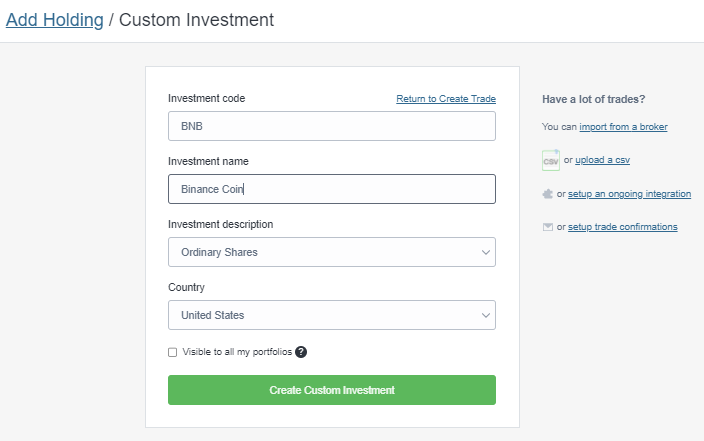

If you trade cryptocurrencies other than the 8 that are supported by Sharesight, you can still track your investments by adding a Custom Investment into your Sharesight portfolio.

To add a Custom Investment, simply click ‘Add New Holding’ on the Portfolio Overview or Holdings page, and select ‘Add a custom investment’ from the top right-hand corner of the Manual Holding box.

When entering a cryptocurrency custom investment into Sharesight, make sure to select the country of the fiat currency used to purchase your cryptocurrency.

Once you have created a Custom Investment, you will be redirected to the Manual Holding screen to add details such as the trade date, trade type, quantity and price. To track the performance of your crypto investment in your portfolio, simply update the price movements by uploading a spreadsheet of prices or manually entering the price movements on a regular basis.

If you are tracking custom crypto investments along with the rest of the stocks in your portfolio, it is also advised that you classify your investments using the Custom Groups feature to easily differentiate between these different asset classes.

See what’s inside your ETFs with Sharesight’s exposure report

See inside your ETFs and get the full picture of your investment portfolio's composition with Sharesight's exposure report.

How KmacD Financial streamlines reporting and saves time with Sharesight

We talk to financial planning firm KmacD Financial about how the Sharesight-AdviserLogic integration helps them save time and streamline client reporting.

Sharesight product updates – November 2023

The focus over the past month has been on implementing additional feature ideas relating to our new (beta) exposure report.