Record-keeping requirements for Australian investors

Disclaimer: The below article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

Whether you trade directly, or use the services of a financial adviser or robo-adviser – and whether you complete your own tax return or work with an accountant or tax agent – the person responsible for keeping up-to-date and accurate records of your shareholdings is you. The good news is that Sharesight’s award-winning investment portfolio tracker makes it easy to store your portfolio-related documentation. Read on to learn how.

The ATO's record-keeping requirements for investors

The Australian Taxation Office (ATO) is very clear in terms of the records investors are required to keep.

| The records you must keep | How long you must keep them |

|---|---|

| Your 'buy' and 'sell' statements (also known as trade confirmations or contract notes) |

Keep these records for 5 years from the date you dispose of your shares |

| Your dividend statements | Keep these records for 5 years from 31 October or, if you lodge later, for 5 years from the date you lodge your tax return |

You will receive most of the records you need to keep from:

- The company that issued the shares

- The relevant share registries for your investments

- Your stockbroker or online share trading provider

- Your financial institution, if you took out a loan to buy the shares.

No matter how organised you are, that’s a lot of paperwork to keep track of and share with your accountant when tax time rolls around. Thankfully Sharesight automates most day-to-day portfolio activities, and allows you to easily store and organise your portfolio-related paperwork.

Investor record-keeping for the ATO using Sharesight

Keeping accurate investor records as part of your ATO compliance is easy with Sharesight. To get started, simply sign-up for a FREE Sharesight account and add your holdings. From there you can:

1. Record all your 'buy' and 'sell' statements from your broker

Recording all of your investment trading activity is easy with Sharesight. Simply attach your official trade confirmation statements to the trade records within your Sharesight portfolio:

By clicking into holdings in your portfolio, you can edit trades to attach records of the relevant trade confirmations.

You can further automate this step by arranging for your broker to email your trade confirmations to your portfolio or by automatically forwarding these emails to Sharesight. This allows your ongoing trades (and your trade confirmations) to be recorded in real-time with no additional effort on your part.

TIP: To see a list of all your trades, simply run the all trades report. You may run the report over any period, and even download it as a .csv, .pdf, or Google Sheet.

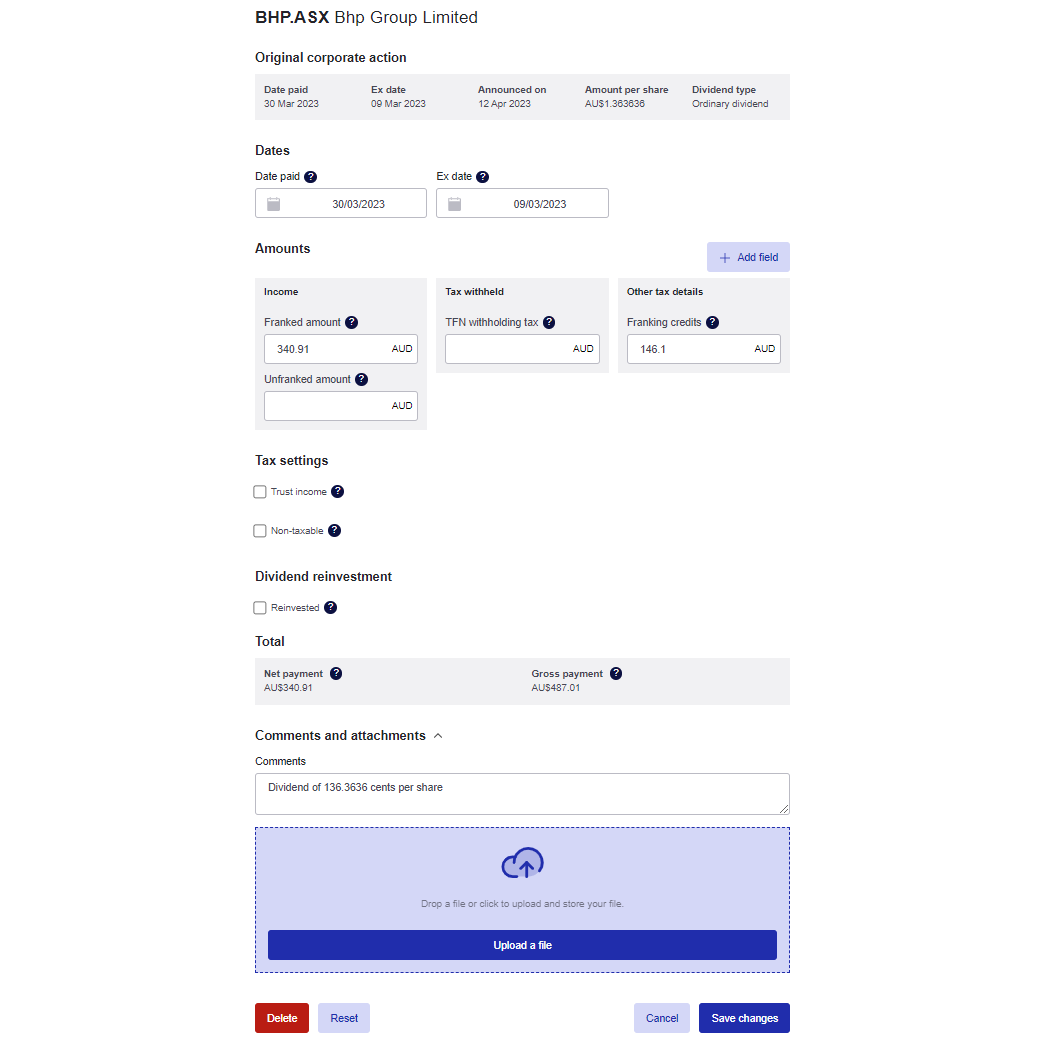

2. Record your dividend income statements

When you add a trade to Sharesight, the system will automatically backfill past dividends (and continue to add new ones as they are announced). You have the ability to edit any of the suggested data, and attach your official dividend statements to the respective dividend entry. This ensures that all your dividend records are safely stored and organised in one place (instead of across your email, filing cabinet, shoe box, etc.)

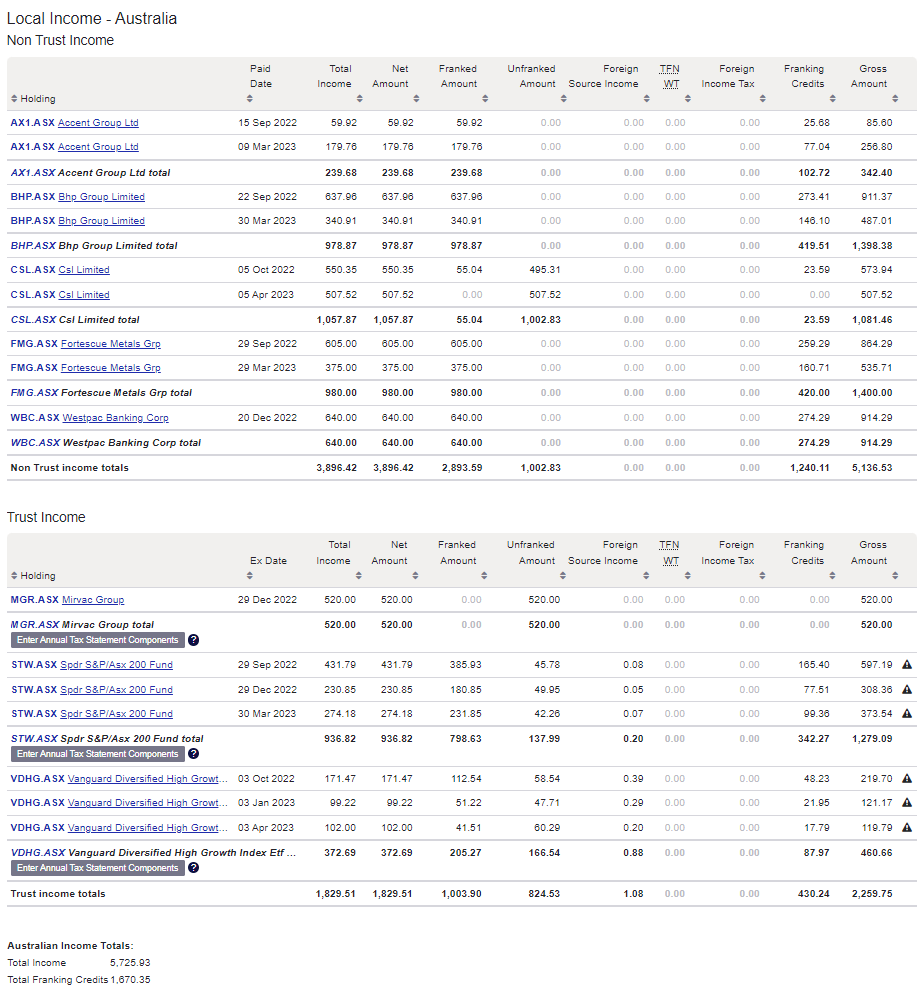

TIP: To see a running list of all the dividends you've ever received, simply run the taxable income report. You may run the report over any period, and even download it as a .csv, .pdf, or Google Sheet:

3. Track the impact of dividend reinvestments on your investment cost base

As per the ATO, if you opt into a dividend reinvestment plan (DRP), “for tax purposes you treat the transaction as though you had received the cash dividend and then used it to buy more shares”.

This means the dividend must be declared as income in your tax return; the additional shares will be subject to capital gains tax (CGT); and the acquisition cost of the additional shares is the amount of the dividends used to acquire them.

Sharesight’s dividend reinvestment feature allows you to activate a DRP for a particular holding and automatically track the reinvested dividends. Alternatively, you may manually reinvest a specific dividend, at the correct reinvestment price. Either way, you’ll have a complete record of all reinvested dividends, as well as their tax implications.

When clicking into an individual holding, scroll down to the Holding Settings to turn on the Auto Dividend Reinvestment feature.

4. Share your records with your accountant

Making sure all your records are correct is a great start, but when it comes to filing your taxes many investors use an accountant. Fortunately Sharesight also lets you easily share secure portfolio access with anyone you wish. So no matter whether an accountant or family member files your taxes, they’ll have everything they need in one place. No more paper chasing, overflowing shoeboxes full of statements, or lost email attachments.

Keep your investing tax records in order with Sharesight

Join thousands of Australian investors already using Sharesight to manage their investment portfolios. With Sharesight you can:

- Automatically track your dividend and distribution income from stocks, ETFs, LICs and Mutual/Managed Funds – including the value of franking credits

- Use the Dividend Reinvestment Plan (DRPs/DRIPs) feature to track the impact of DRP transactions on your performance (and tax)

- See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

- Run powerful tax reports to calculate your dividend income with the taxable income report

- Plus calculate your CGT obligations with Sharesight's Australian capital gains Tax Report and unrealised capital gains tax report

To get started for FREE, simply sign up, import your holdings and watch as dividends and prices are automatically updated. If you decide to upgrade, you’ll unlock advanced features and everything you need to run your tax reports and gain unparalleled insights into your portfolio performance throughout the year.

Plus, as an Australian tax resident, you can save even more by claiming your Sharesight subscription fees on your tax return.1

FURTHER READING

- 5 ways Sharesight helps Australian investors at tax time

- Capital gains tax calculator for Australian investors

- 7 reasons why Sharesight is better than a spreadsheet

1 If you derive income from the share market, your Sharesight subscription may be tax deductible. Check with your accountant for details.

See what’s inside your ETFs with Sharesight’s exposure report

See inside your ETFs and get the full picture of your investment portfolio's composition with Sharesight's exposure report.

How KmacD Financial streamlines reporting and saves time with Sharesight

We talk to financial planning firm KmacD Financial about how the Sharesight-AdviserLogic integration helps them save time and streamline client reporting.

Sharesight product updates – November 2023

The focus over the past month has been on implementing additional feature ideas relating to our new (beta) exposure report.