Top countries and brokers Aussies use to invest in global markets

After a poor-performing FY21/22, the ASX200 propelled upwards in FY22/23, ending the year up by 9.7% (or 14.8% inclusive of dividends). While many economies around the world were impacted by inflation, tightening financial conditions and geopolitical tensions, savvy Australian investors continued to hedge their bets and diversify into global markets, rather than relying solely on ASX investments to produce returns.

Based on data from Sharesight’s userbase, this blog delves into the most popular global markets for Australian investors and some of the reasons why these markets were in such high demand during FY22/23. We also reveal the top brokers for international trades and some of the features that make these brokers so sought-after by Australian investors looking to diversify their portfolios.

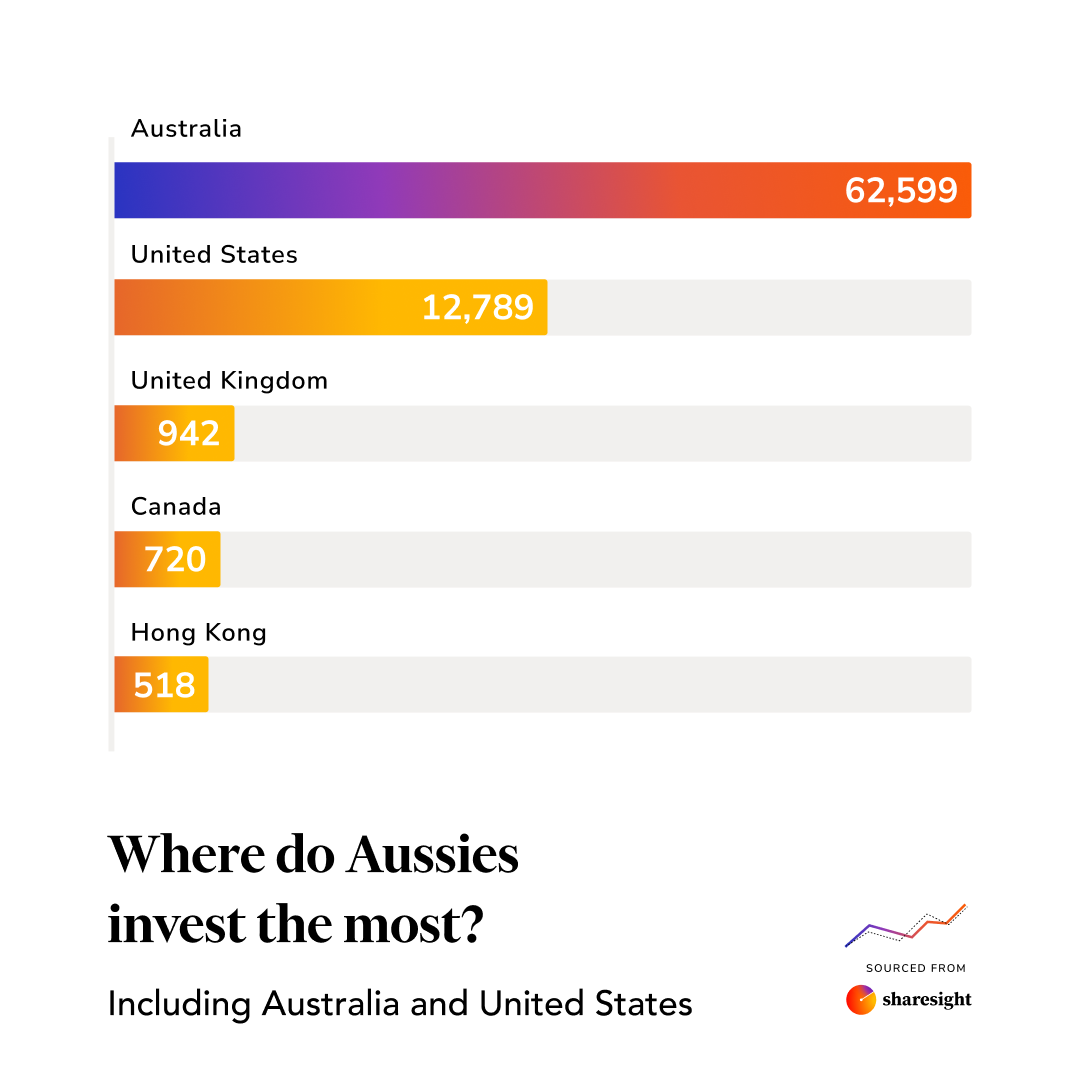

Most popular countries for Australian investors

As you might expect, Australian investors strongly prefer investing in the local market, with the US being a strong second choice.

International markets most popular with Australian investors, based on Sharesight’s userbase

International markets most popular with Australian investors, based on Sharesight’s userbase

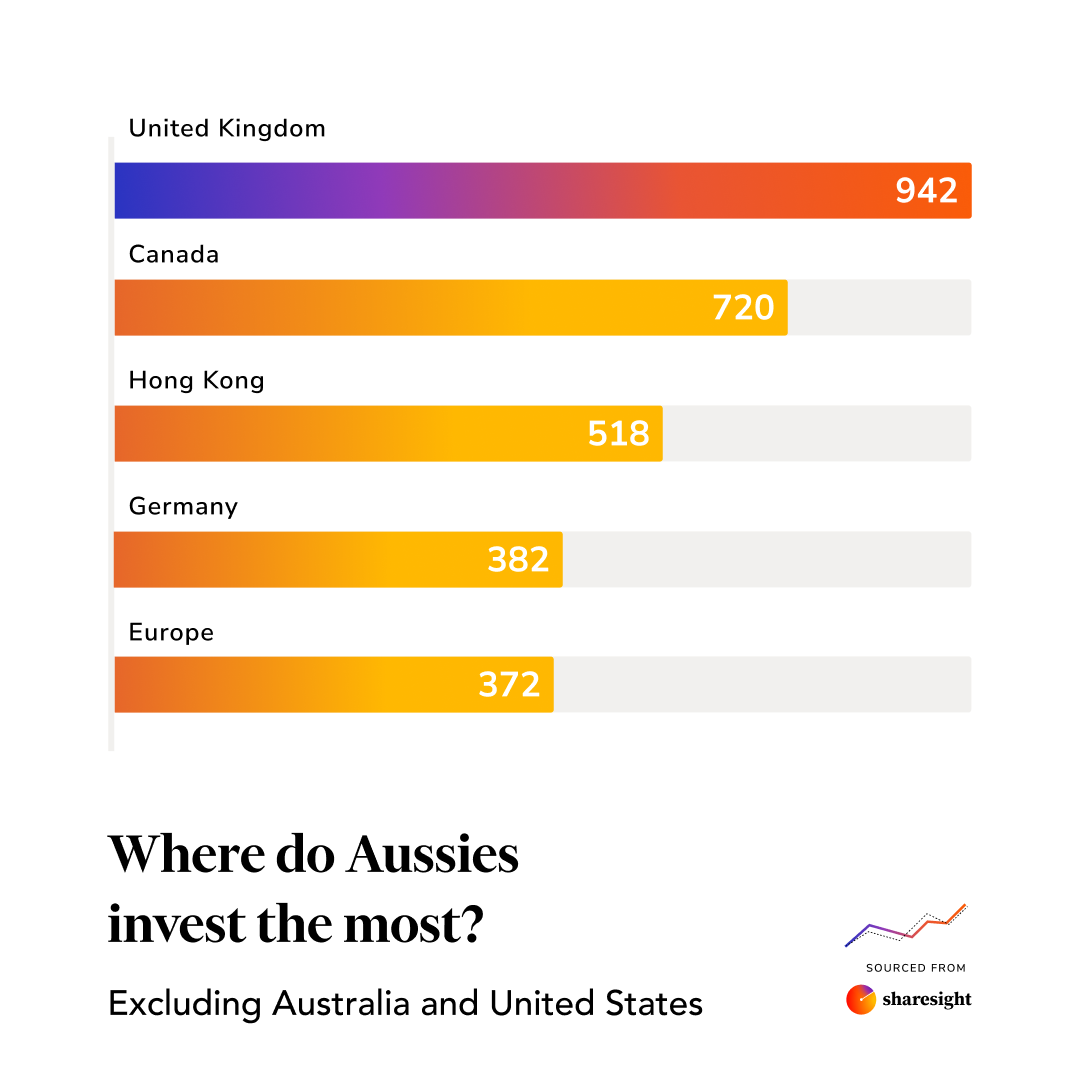

Once we remove Australia and the US from the dataset and zoom in to look at the remaining international markets, we can see that the UK, Canada, Hong Kong, Germany and broader Europe are also popular choices for Australian investors.

International markets most popular with Australian investors, excluding Australia and the US

International markets most popular with Australian investors, excluding Australia and the US

Why Australian investors are investing in overseas markets

While the ASX performed well in FY22/23, it represents only 2% of the global equities market – leading savvy investors to look to overseas markets to diversify their portfolios. For Australian and global investors alike, markets such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), Hong Kong Stock Exchange (HKEX) and Nasdaq are typically popular choices as they provide investors with access to some of the world’s highest-valued companies, including a diverse range of industries and sectors.

Looking at the charts above, we can also observe a correlation between the most popular international markets and Australian expat numbers. For example, as seen in the latest ABS data, the UK, US, Hong Kong and Germany are all part of the top 20 most common countries for expats to Australia. Another potential explaining factor for investors’ preferred markets includes the tendency for investors to invest in markets where they understand the language.

“It’s really a no-brainer that more Aussies are looking to invest overseas,” says Michael Abson, Marketing Manager for CMC Invest.

“All your big-cap US stocks are there, some of which are providing impressive returns that outpace the ASX. Even though the AUD is struggling at the moment, there’s still a huge amount of market excitement overseas.”

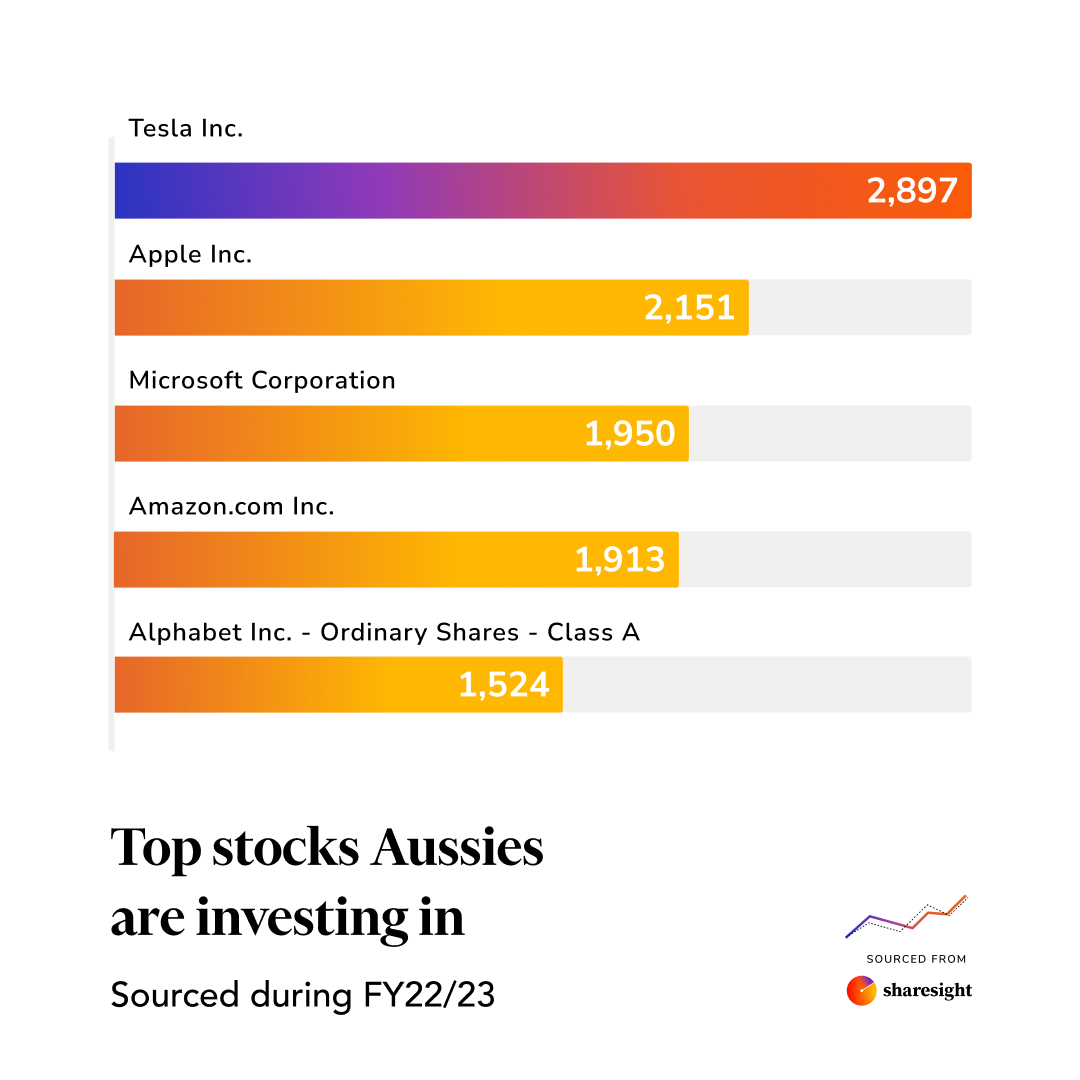

Most popular stocks for international trades

Diving deeper into the data, we can see that Australian investors’ most popular trade of FY22/23 was Tesla (NASDAQ: TSLA). This corresponds to our trading data from that period, which shows that Tesla has consistently been one of investors’ most popular buy and sell trades. This is likely due to the strong performance of Tesla’s share price over the past few years, with opportunistic investors taking advantage of the stock’s steep downward trend during Q2 of the financial year.

Tesla and Apple topped the list of Australian investors’ most-traded international stocks in FY22/23

Tesla and Apple topped the list of Australian investors’ most-traded international stocks in FY22/23

Similarly, Apple (NASDAQ: AAPL) has always been a popular investment for Sharesight users and this was no different in FY22/23. With the ongoing success of the iPhone and other Apple products, plus the company’s exponential share price growth over the past decade, it’s not hard to see why Apple was one of the top choices for Australian investors.

Microsoft (NASDAQ: MSFT) was also a popular trade for Australian investors in FY22/23. Despite the stock experiencing a rare downward trend throughout 2022, Microsoft’s share price has seen strong and steady growth over the past five years and remains a popular choice for Australian investors looking for exposure to the US tech market.

Most popular Australian brokers for international trades

As can be seen in the chart below, Australian investors’ favourite broker for international trades was CMC Markets, followed by Stake.

Most popular Australian brokers for international trades, including the US

Most popular Australian brokers for international trades, including the US

If we exclude US trades from the data, CMC remains users’ broker of choice, followed by Interactive Investors and Saxo Markets.

Most popular Australian brokers for international trades, excluding the US

Most popular Australian brokers for international trades, excluding the US

Why these brokers are a popular choice for international trades

It’s clear why CMC Markets was Australian investors’ favourite broker for international trades, with access to US, UK, Canadian and Japanese markets for $0 brokerage fees.1 As our data is based on the Sharesight userbase, it should also be noted that CMC’s connection to the Sharesight API allows investors to automatically sync their historical and ongoing trades to Sharesight, making it effortless for investors to track their international trades along with the rest of their investments.

“CMC makes investing internationally just as easy as trading locally,” says Michael.

“You get a consolidated view of your portfolio, powerful charting, rich insights and there’s no need to juggle separate currency wallets.”

Looking at the data inclusive of US trading, we can also see that Stake was a popular broker choice among Sharesight’s Australian userbase. This is likely due to its support for US markets with $0 brokerage fees. Investors using Sharesight can also import their historical and ongoing US trades from Stake via spreadsheet file or by automatically forwarding their trade confirmation emails – another convenient way for investors to keep track of their Stake trades.

It is also likely that Interactive Brokers was a popular choice due to its extensive global market support, plus Sharesight users’ ability to easily import their trades.

Track all your investments in one place with Sharesight

Thousands of global investors like you are already using Sharesight to manage their investment portfolios. What are you waiting for? Sign up and:

- Track all of your investments in one place, including stocks, ETFs, mutual/managed funds, property and even cryptocurrency

- Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, future income, multi-period and multi-currency valuation

- See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

- Track stocks on over 40 global exchanges with Sharesight

- Automatically track trades from over 200 global brokers

- Track investments in over 100 currencies

Notes

-

FX spreads apply

↩

See what’s inside your ETFs with Sharesight’s exposure report

See inside your ETFs and get the full picture of your investment portfolio's composition with Sharesight's exposure report.

How KmacD Financial streamlines reporting and saves time with Sharesight

We talk to financial planning firm KmacD Financial about how the Sharesight-AdviserLogic integration helps them save time and streamline client reporting.

Sharesight product updates – November 2023

The focus over the past month has been on implementing additional feature ideas relating to our new (beta) exposure report.