Why do I need Sharesight with my online broker?

Investors are misinformed about what an online broker does and doesn’t do. More interesting still is why online brokers refuse to do what Sharesight can. We’re spoilt these days when it comes to online “life-admin.” If I can change the temperature in my lounge room with an app on my phone, or instantly track every A380 in the sky, why can’t I see my dividend income on my broker’s website?

Understanding the backstory helps

Online brokers took off during the .com bubble of the late 90’s. The irony is the very medium which made it easy for DIY investors to get into the market provided the ingredients for an epic downturn later on (correlation not causation). Over the next 10 years, traditional banks and upstart independents competed in an arms race by adding research, real-time quotes, and technical charting. What constitutes a new feature these days is pretty weak. Drag and drop trading windows don’t exactly move us to tears. The truth is, most of the trading systems remain totally unchanged on the backend, with only skin-deep changes to their interfaces.

The fierce competition between banks and the independents led to one, inevitable outcome: downward pricing pressure. Our partners at CMC offer trades for $11 per month, which seems like an Australian-best. Bell Direct isn’t far behind at $15 per trade. Robinhood, a US-based broker now offers $0 trading, hoping to make money by selling margin loans and by broadening their reach via their API (sound familiar?).

So if online broking is commoditised, why does Commsec (CBA) still own 51% of the Australian market share when their trades are a whopping $19.95?

Because switching brokers is a huge pain the ass, and investors lose critical data when doing so. And your broker knows this.

If you switch brokers, you transfer your opening balance and that’s it. This is exactly like switching from one bank to another. The new bank only knows your balance on day one, not what you spent on groceries the day before. Gone is your trading history, which means your new broker can’t calculate performance, which means you have no basis to work out your capital gains position. And now you’re in trouble come tax season.

To make things worse, brokers don’t collect your dividend information -- regardless if you've been with the same broker forever. They don’t know when you’ve enrolled in a dividend reinvestment plan and they’re not involved when you’re paid a dividend. Even if you use a cash account linked to your broker to reconcile buys and sells, the dividends are recorded like any other credit. Since your dividend records are maintained separately, now you’ve got something else to worry about when switching brokers.

Ever wonder why when you login to your broker you don’t see a performance calculation? This is the most important data point aside from portfolio value. They don’t bother with this functionality because they can’t calculate it -- nor should they, it's not their core competency.

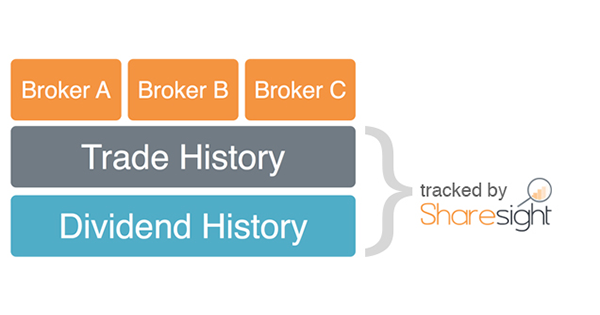

Enter Sharesight. We float over the top of your broker (or brokers) to provide uninterrupted transaction, performance, and dividend records. All in a purpose-built application that’s great to use. Not only can you run tax and performance reports, you can actually connect your portfolio to other, useful applications like Xero. Once your data is live on Sharesight, you’re free to switch brokers (or even platforms or wraps).

So if I’m a big broker with huge market share, why would I want to build features that make it easier for my clients to switch? Online brokers provide a great service for DIY investors: cost-effective access to a growing array of investment products. Our encouragement would be to find one that doesn’t want to fence you in.

For those of you who scrolled to the bottom, here's a recap:

Why do I need Sharesight with my online broker?

- To calculate real, accurate, and uninterrupted performance

- To include dividends and corporate actions in your portfolio's performance

- To enable switching brokers and to aggregate data from multiple sources

- To bring your portfolio online to connect with other apps in the Sharesight ecosystem (e.g. Xero, Simply Wall St, etc.)

- To treat your portfolio with some respect by using a purpose-built, kick-ass application!

FURTHER READING

See what’s inside your ETFs with Sharesight’s exposure report

See inside your ETFs and get the full picture of your investment portfolio's composition with Sharesight's exposure report.

How KmacD Financial streamlines reporting and saves time with Sharesight

We talk to financial planning firm KmacD Financial about how the Sharesight-AdviserLogic integration helps them save time and streamline client reporting.

Sharesight product updates – November 2023

The focus over the past month has been on implementing additional feature ideas relating to our new (beta) exposure report.